Today's focus is on the State contribution to the State deferred compensation plan.

This provision is contained in Article 16 - Wages, Section 16 found on page 33 of the MMA contract.

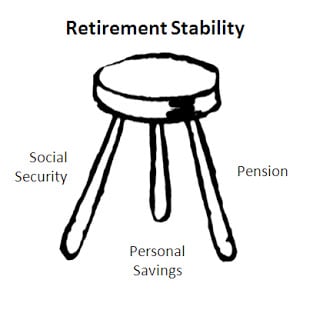

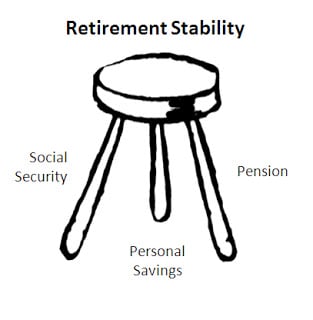

The Minnesota Deferred Compensation Plan (MNDCP) is a volu ntary savings plan intended for long-term investing for retirement. Authorized under Section 457 of the Internal Revenue Code, the MNDCP is a smart and easy way to supplement retirement income from your Minnesota public pension and Social Security benefits.

ntary savings plan intended for long-term investing for retirement. Authorized under Section 457 of the Internal Revenue Code, the MNDCP is a smart and easy way to supplement retirement income from your Minnesota public pension and Social Security benefits.

Available to any full-time, part-time, or temporary Minnesota public employee (state, city, county, township, school districts, etc.), the MNDCP allows you to build retirement savings through automatic payroll deductions -- you control how your money is invested.

You are eligible to withdraw savings from your MNDCP account upon retirement, termination of employment or disability. Upon your death, your designated beneficiary(ies) can withdraw funds.

If you choose to participate in this voluntary savings plan through payroll deduction you can receive up to an additional $325 per year through a match provided by the State of Minnesota. In order to receive the match you must contribute to MNDCP. The state-paid contribution shall be in an amount matching supervisor contributions on a dollar for dollar basis, not to exceed three hundred twenty-five dollars ($325) per supervisor per fiscal year.

To receive this benefit you must choose this option, on the Selection of Deferred Compensation option form that you must complete and submit each fiscal year by June 7th. The selection of Deferred Compensation form is available at: http://www.mn.gov/mmb/accounting/payroll/Forms/